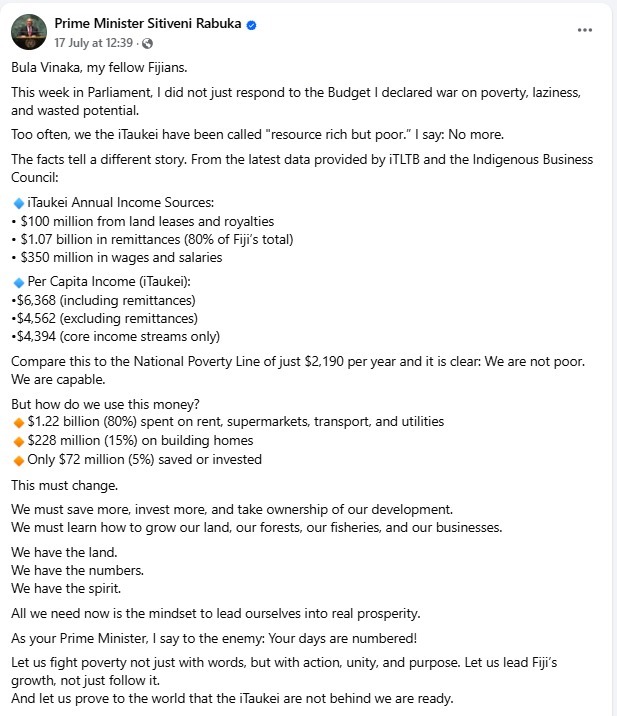

Fiji Prime Minister, Honourable Sitiveni Rabuka - on iTaukei incomes (Facebook post - 17 July 2025)

Fiji Prime Minister, Honourable Sitiveni Rabuka - on iTaukei incomes (Facebook post - 17 July 2025)

1 Views

0 Comments

iTaukei Board rejects poorly planned village projects

https://www.fbcnews.com.fj/news/itaukei-board-rejects-poorly-planned-village-projectsiTaukei Board rejects poorly planned village projects(Source : Fiji Sun - Reporter : Peceli NaviticokoMultimedia Journalist - July 30, 2025) Poorly written business proposals are slowing down funding approvals for iTaukei village projects, says the iTaukei Trust Fund Board.Chief Executive Aisake Taito states that many applications are rejected because they lack important details such as cash flow, quotations, and cost breakdowns.He said villagers must treat business proposals like loan applications and use the proper template to meet all funding requirements.“Always remember, when you prepare any project or business proposal, it should include all the required elements, such as cash flows. Just like applying to a bank, all requirements must be met with proper details and a solid business plan. There is a proper template for this, so seek assistance from the provincial offices.”Proposals, according to Taito, must also show transparency and accountability.iTaukei Affairs Minister Ifereimi Vasu said village projects should not be rushed and must meet high standards.He states that if a hall is being extended for business, the final structure must be strong and match the quality of those in town areas.He adds that villagers must get proper contractors and not cut corners with cheap work.Both Taito and Vasu stress that working closely with provincial offices will help avoid delays and project duplication.

$3m to Back iTaukei Business Ventures

https://fijisun.com.fj/2025/04/11/3m-to-back-itaukei-business-ventures/$3m to Back iTaukei Business Ventures(Source : Fiji Sun - Reporter : Mereleki Nai 11 Apr 2025) Minister for iTaukei Affairs Ifereimi Vasu.An assistance of $3million will empower iTaukei landowners to bolster their business ventures.Minister for iTaukei Affairs Ifereimi Vasu said there was a challenge for iTaukei people to venture into businesses with the resources they possessed.He said in 2024, the iTaukei Land Trust Board (TLTB) approved financially backing 46 iTaukei businesses with total assistance of $3 million.This support encompassed 23 businesses that were formed through trusts, cooperatives, and iTaukei companies alongside 23 individual businesses.The minister said a report by the Fiji Bureau of Statistics highlighted that 75 per cent of the iTaukei lived in poverty.“We, the Coalition Government, want to change that report by setting up initiatives to uplift the landowners in operating businesses”.He said the iTaukei Trust Fund Investment was also regulated in 2024 to assist landowners.“The fund requires no initial deposit for registered iTaukei individuals in the iTaukei registry known as the Vola ni Kawa Bula (VKB),” Mr Vasu said.“An interest of 2.5 per cent to start under an agreed repayment period with $4 million set aside to assist the landowning trustee or company and $1 million to assist individual iTaukei and a further $1 million set aside to assist ecotourism operators.”He said the TLTB had provided assistance to empower iTaukei landowners and foster economic growth through targeted investments and support for the future of their community.

State subsidies for iTaukei loans

https://www.fijitimes.com.fj/state-subsidies-for-itaukei-loansState subsidies for iTaukei loansFiji Times - Published: March 18, 2025 | By JOSEFA SIGAVOLAVOLA Merchant Finance and the Ministry have further reaffirmed their commitment to the effective management of the subsidy funds. Picture: SUPPLIED/MFLMERCHANT Finance Pte Limited (MFL) and the Ministry of Itaukei Affairs have signed a Memorandum of Understanding (MoU) aimed to provide payments of interest subsidy by the Government for loans provided by Merchant Finance to resource owners in the country.Permanent Secretary for itaukei Affairs Pita Tagicakirewa said such partnerships with private sector players were crucial when creating economic opportunities for iTaukei business owners.“This agreement will enable MFL and the iTaukei Affairs Ministry to complement ongoing economic development initiatives for resource owners while improving access to finance services and products for indigenous entrepreneurs,” Mr Tagicakirewa said.Additionally, the MoU will allow MFL’s Vanua Finance to manage the government’s approved interest subsidy scheme, which is designed to alleviate financial constraints and encourage investments in sectors like land subdivision, resource extraction, revenue generating activities in the tourism sector and commercial property investment.A recent statement highlighted that this will provide iTaukei-owned business with access to financing under favourable terms such as reducing borrowing costs and enhancing long term sustainability.The statement adds that from July 2024 to December 2024, Merchant Finance has financed 104 iTaukei owned businesses with loans of $11m.“Out of these, 19 loans fall into the focus areas of Vanua Finance where Government was requested to provide interest subsidies.“To date, seven loans under the interest subsidy requests have been approved, totalling $329,217.63.“Comprising of four land subdivision projects supplying a total of 90 lots, one renewable energy initiative for solar-powered refrigeration and cooling systems for a village store based in the province of Lau and two tourism development projects aimed at enhancing local economic opportunities for their communities,” it stated.Merchant Finance is currently awaiting approval for the December 2024 submission to Government for the remaining 12 loans and is also working on the March 2025 submission for the next batch of customers.Merchant Finance and the Ministry have further reaffirmed their commitment to the effective management of the subsidy funds.Regular reporting, monitoring and evaluation mechanisms are in place to track progress and measure the interest subsidy initiative’s impact.

Write A Comment